Xcel’s bogus demand forecast basis for CapX

Remember Xcel’s CapX 2020 peak demand projections of 2.49% annual increase? How wrong can they be? And how unjustified was their basis for a Certificate of Need for CapX 2020? And how are they held accountable for those gross misrepresentations? But now it’s time to pay, and who will pay? This is why the rate case in progress, PUC Docket 15-826, is so important.

Remember Xcel’s CapX 2020 peak demand projections of 2.49% annual increase? How wrong can they be? And how unjustified was their basis for a Certificate of Need for CapX 2020? And how are they held accountable for those gross misrepresentations? But now it’s time to pay, and who will pay? This is why the rate case in progress, PUC Docket 15-826, is so important.

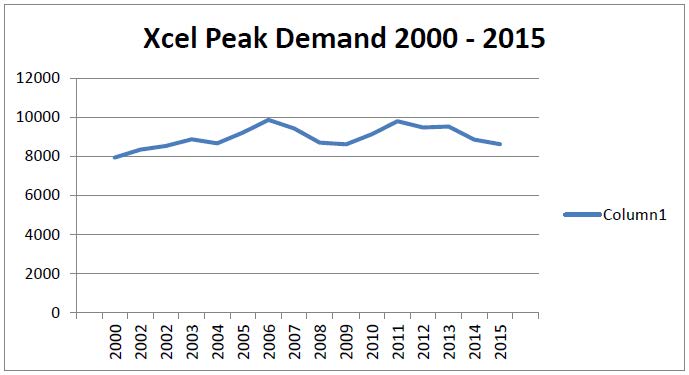

On the other hand, I love it when this happens… Xcel Peak Demand is again DOWN! There’s a trend, and it’s called decreased demand. Demand has yet to exceed the 2007 peak, and now it’s 8 years…

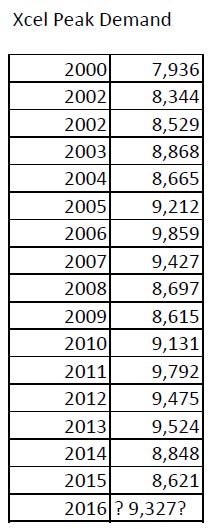

Here’s the Xcel Energy SEC 10-K filed a couple days ago:

Is it any wonder they want to get away from a cost based rate a la their “e21 Initiative” scheme? Particularly now that the bill for CapX 2020 is coming due and their newest rate case (PUC Docket GR-15-826) is now underway?

And the specifics, and note how they inexplicably forecast a 2016 peak of 9,327, which is based on a “normal weather conditions” assumption:

Comments

Xcel’s bogus demand forecast basis for CapX — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>